capital gains tax canada calculator

But also can dive even deeper to reduce the. For a Canadian who falls in a 33 marginal.

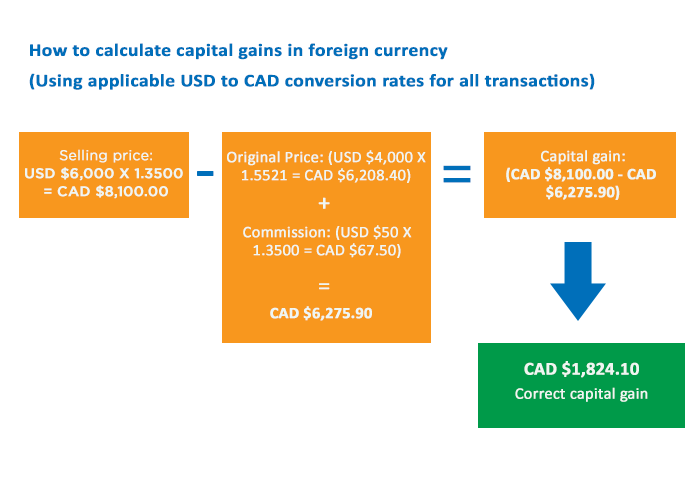

Capital Gains 101 How To Calculate Transactions In Foreign Currency

Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

. How to calculate capital gains tax. If income is moved from other income to Canadian dividends total taxes will be reduced even as the OAS clawback increases. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

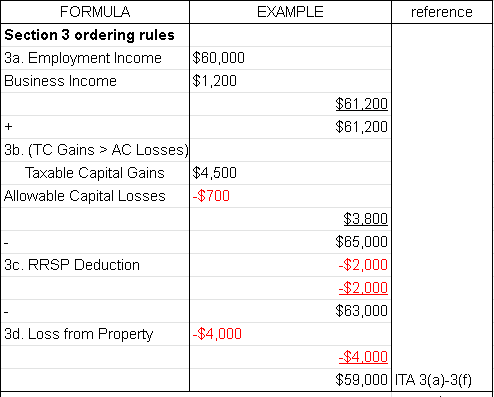

Proceeds of disposition Adjusted cost base Expenses on disposition Capital gain. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. However if their annual.

Do not include any capital gains or losses in your business or. In Canada 50 of the value of any capital gains are taxable. For instance if you sell a.

Build Your Future With a Firm that has 85 Years of Investment Experience. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Capital gains tax is calculated as follows.

This calculator includes the same taxes and tax credits as the. Completing your tax return. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to.

This rate is higher for the sale of a primary residence. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax.

Since its more than your ACB you have a capital gain. CAPITAL GAIN PURCHASE PRICE SELLING PRICE. When selling a non-primary residence it is best to.

The taxes in Canada are calculated based on two critical variables. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. Calculations are estimates based on the tax law as of.

All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223 tax year. ICalculator is packed with financial. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province.

Investors pay Canadian capital gains tax on 50 of the capital gain amount. Long-term capital gains tax profit from the sale of asset or property held a year or longer rates are 0 15 or 20. The sale price minus your ACB is the capital gain that youll need to pay tax on.

This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say. Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces. You will need information from your records or supporting documents to calculate your capital gains or.

The inclusion rate refers to how much of your capital gains will be taxed by the CRA. Capital Gains Calculator - Know more about capital gains Calculate the tax payable under capital gain with squareyards Capital Gain Calculator. Build Your Future With a Firm that has 85 Years of Investment Experience.

Capital Gains 2021. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Use our capital gains calculator to determine how much tax you might pay on sold assets.

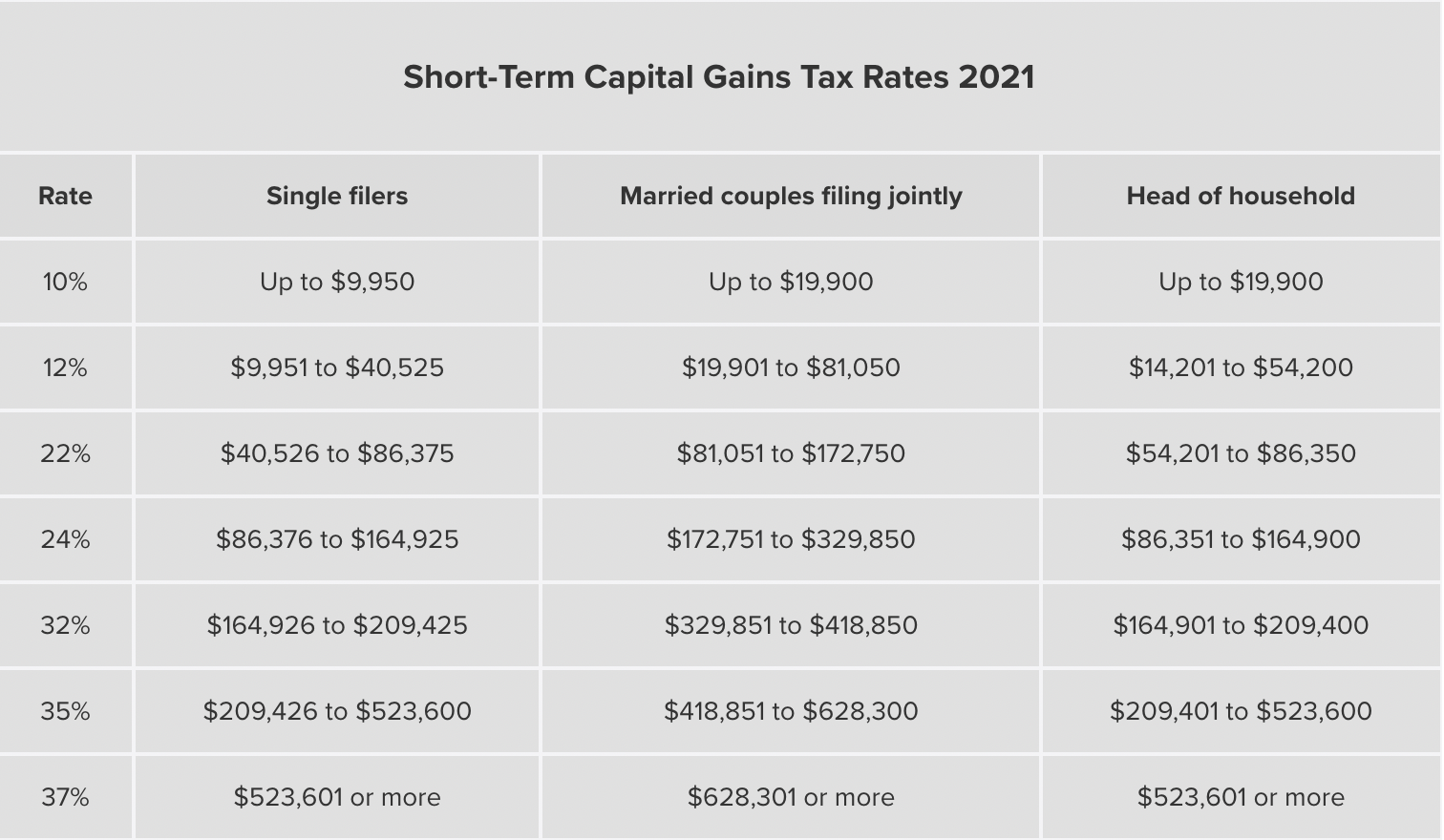

High net worth individuals and investors may need to consider the. For instance in 2021 individuals who file tax returns will be exempt from paying any kind of capital gains tax if their total taxable income is less than 40400. And the tax rate depends on your income.

2022 free Canada income tax calculator to quickly estimate your provincial taxes. Find out your tax brackets and how much Federal and Provincial. In Canada the capital gains tax on sale of property is 50 of the gain.

Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. Short-term capital gain tax or profit from the sale of an asset. New Hampshire doesnt tax income but does tax dividends and interest.

Your sale price 3950- your ACB 13002650. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Capital Gains Tax Calculator.

This above is a simple-math calculation of the capital gain.

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

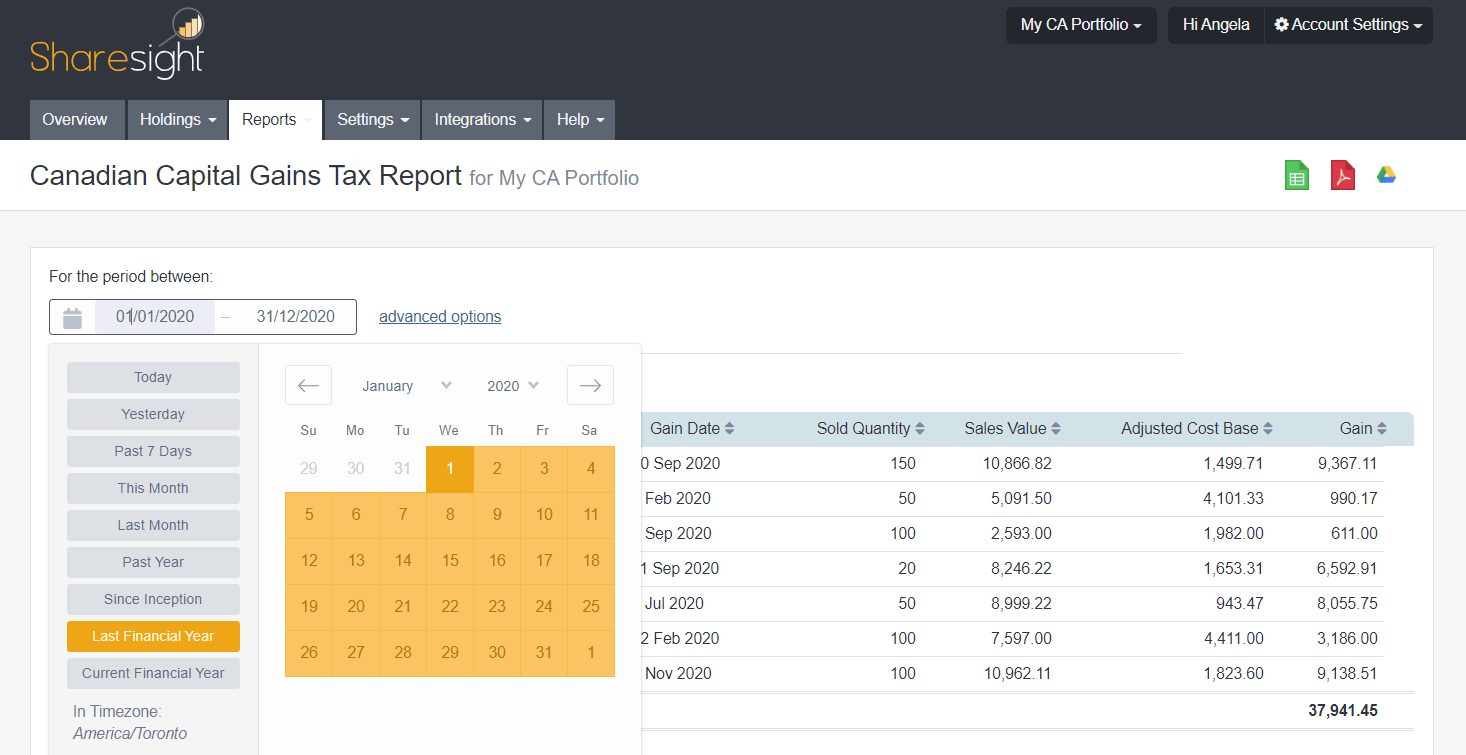

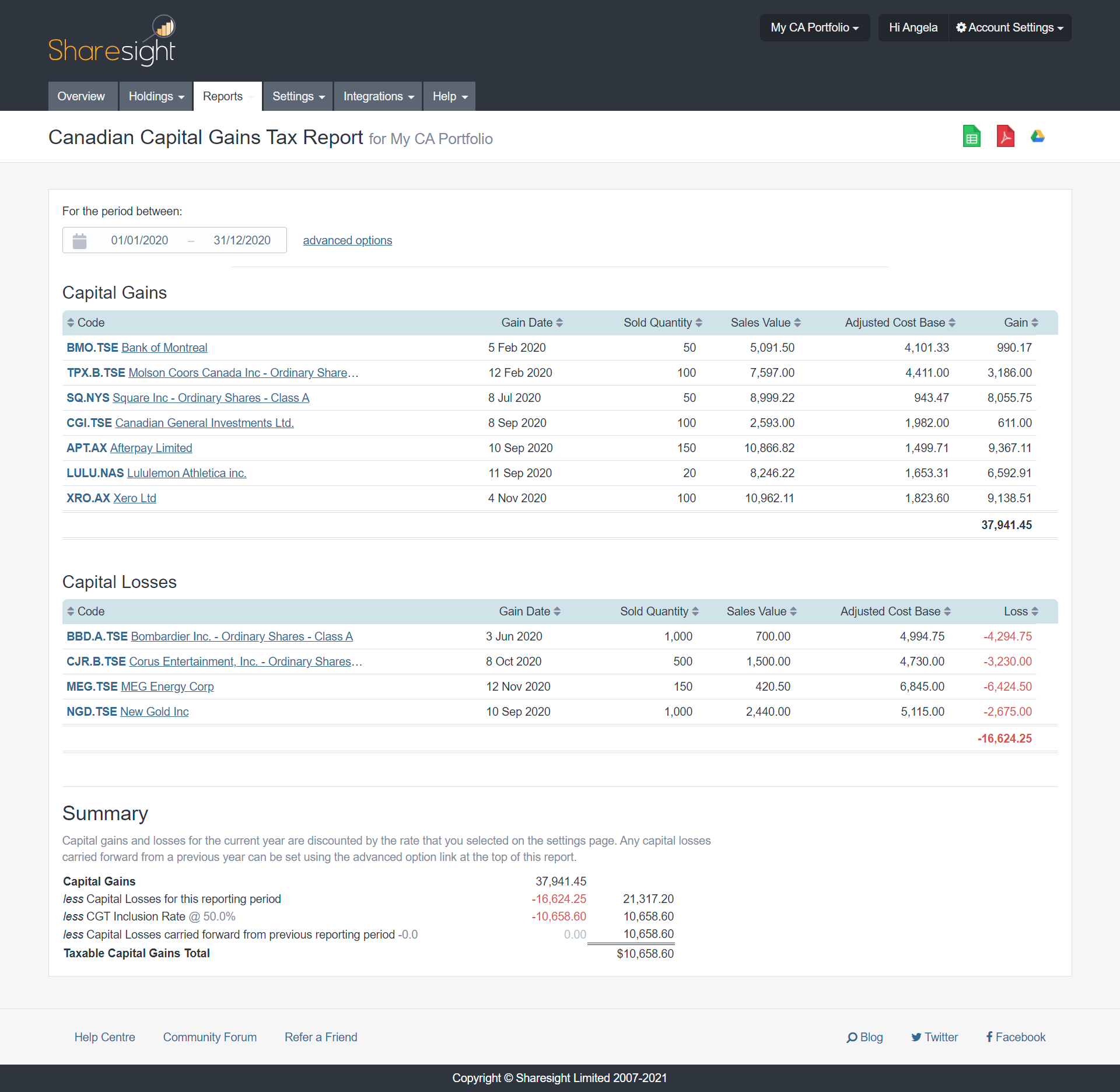

Canadian Capital Gains Tax Report Makes Tax Time Easy

Canada Capital Gains Tax Calculator 2021 Nesto Ca

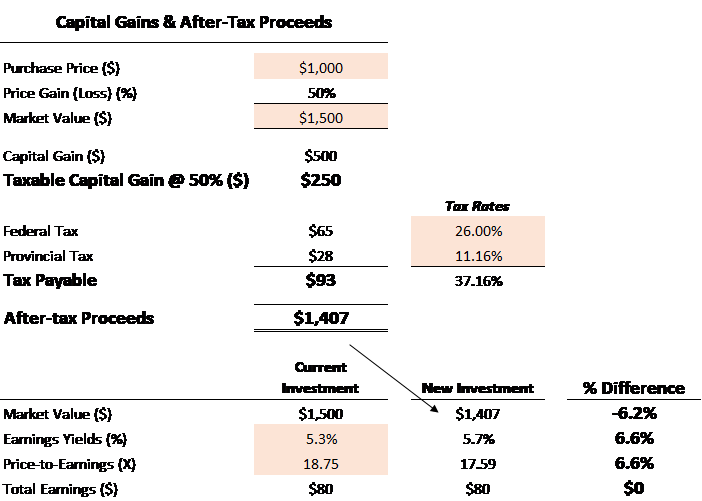

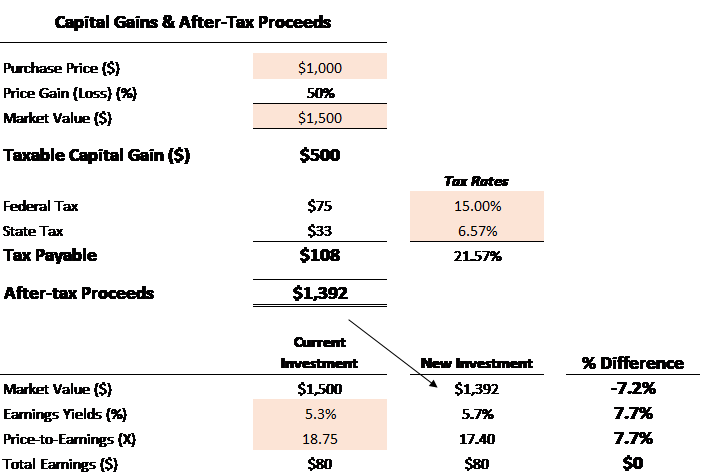

Capital Gains Tax Calculator For Relative Value Investing

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

Capital Gains Tax Calculator For Relative Value Investing

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Tax Calculator 2022 Casaplorer

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Canadian Capital Gains Tax Report Makes Tax Time Easy

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Capital Gains Tax What It Is How It Works Seeking Alpha

Canadian Capital Gains Tax Report Makes Tax Time Easy

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

How To Calculate Tax Payable On The Sale Of Your Rental Properties